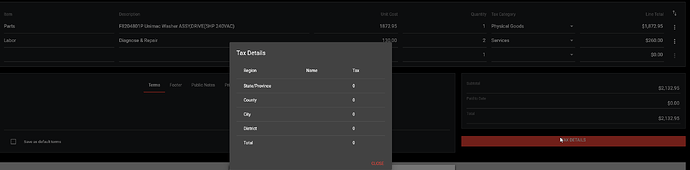

I can’t figure out why taxes are not calculating… Any hints?

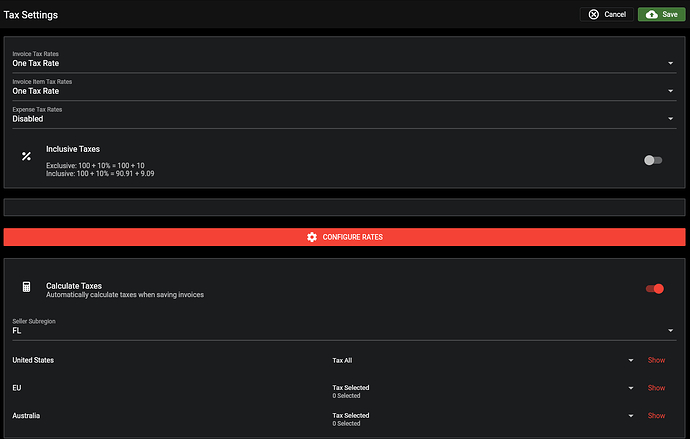

All setup according to Free Source Available Invoicing, Expenses & Time-Tracking | Invoice Ninja

Quotes and invoices same - no taxes at all.

Hi,

Do the company and client have their full addresses set?

Didn’t realize those a separate entities. Client had full address. Client’s company had only State.

I’ve added full address - nothing changed. still no tax calculation.

My entity has address filled out.

State is filled like Fl. Not full Florida.

There is no mention of tax calculation in Free Source Available Invoicing, Expenses & Time-Tracking | Invoice Ninja

only says that

A “Client” can either represent a person or a company. If only the contact information is set the contact name will be used as the client’s display name. If the client’s name is set then it will be used instead.

I assumed it will pull the clients address for tax purposes.

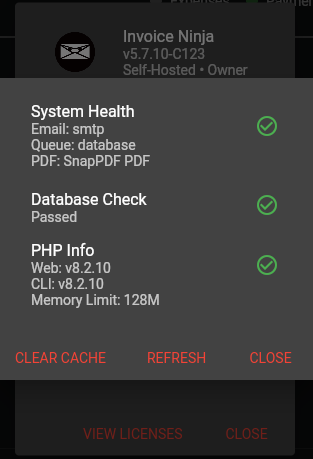

Which version of the app are you using?

@david do you have any suggestions for things to check?

please help… May be there are logs or something to check?

If something is missing - shouldn’t it say something? Like hay, dude, your taxes aren’t calculated - you didn’t tick this, or that is not setup for the formula to work?

From the screenshot above it looks like the tax address isn’t recognized for the company or client, we’ll look into making this easier to track down in the app.

I had a suspicion about it, which way to look to verify?

I’ve entered multiple clients, same city, different street address. No taxes for all of them.

There isn’t a way to check directly in the app, we’ll work to improve it.

Well…

Are you saying there is nothing can be done to work around this?

Not an address change? No way to make it glitch and say anything?

Are there any users out here that has this working on self hosted setup?

I believe you’ll need to obtain a key from ziptax

We’ll look into adding a message about this in the app.

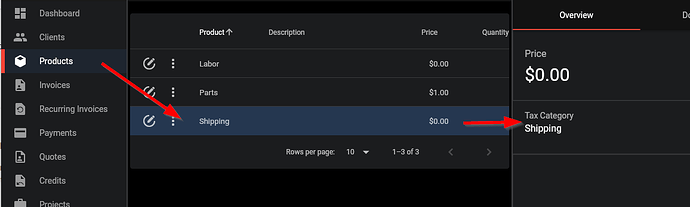

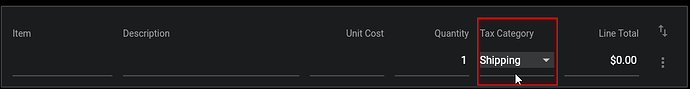

I need to get a mandatory paid service to be able to distinguish predefined shipping category in the line (quote/invoice) from the rest of the lines to not charge tax on it?

That is a bit “overkill” don’t you think?

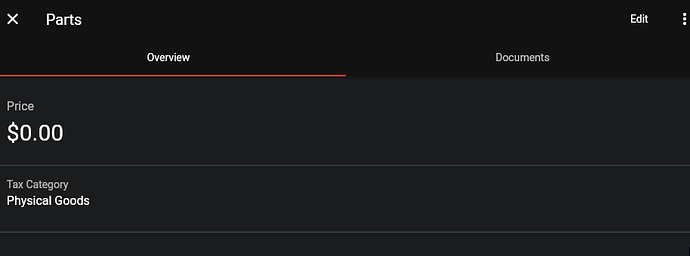

I’ve tried setting up products, thinking maybe tax calculation is not triggered until there are products. And you can clearly set type of product in there.

As well as in the invoice itself.

Shipping is just an example, I’ve tried all product categories and different combos of them.

For the people who are a small local business like an electrician or appliance repair, mom and pop shop with pants fitting service, they don’t sell to a 100 of cmall cities in a bunch of random counties. There is no need for any AI to figure out taxes for them. It a set rate.

If the rate is set for the product you can disable the auto-tax feature and set the default tax rate on the product itself.

In my case, the product is labor. Parts in the invoice can’t be catalogued within products module, because they are different every time.

So I created a pretend product to see if I could trigger the line tax calculation this way. It didn’t work.

Maybe including states selection from drop down menu will reduce confusion?

If you’re working in the US you’ll need to either get an API key from ziptax or disable the auto-tax feature. Sorry, it depends on an address lookup feature which requires the API.

Hilarious. So if there is anything wrong with communication or uptime for 3rd party - kaput.

I imagine these 3rd party APIs are pretty reliable, but yes… if the API is down the feature wouldn’t work