Hello @david, I’ve been following this thread for a while as I too needed negative credit notes the way it’s been described here. I managed to note reimbursements until now by using negative invoices and negative payments, but properly labeled credit notes will be even better. Thanks for adding this feature.

This is working well in my tests, but I noticed that if a negative created credit is marked as paid while it’s still a draft, this will create a payment with a null value ($0.) In comparison, when an invoice is still a draft but it’s mark as paid, a payment will be created for its full amount. To prevent the null payment of the credit not, an additional step of marking it as sent must be done, and only then can the payment reflect the amount of the negative credit. Is this normal?

As a (lengthy) sidenote, I don’t mean to highjack the thread, but I think this is related: regarding the positive credit notes, I’m a bit confused about how they work. You said:

As @ecomsilio said, if that’s some kind of deposit, it makes sense to me:

I could not find the exact workflow to reproduce this, however, since I can’t seem to apply a blank payment to a positive credit.

Nontheless, apparently credits can also be created without being linked to payments with real money, and those credits can then be used to pay real invoices. I was wondering, is there a way for them to be deducted from an invoice instead of applied to them? Because as I understand the way it works currently, positive credits can be used without associated payments as some kind of “virtual money” that can be used for a new payment, and I get why that would work in some cases, but IMO it poses a problem when taxes are involved. In fact, if sales taxes are charged, usually they have to be paid back to the government. But what happens if there was no actual payment, only a “virtual payment” with “virtual money” ? One would have to pay back taxes with real money from a real account, even if those taxes were never really paid by the client. Same goes for income taxes: with credit notes as payments, one would have to declare revenues that are in fact never really earned, since they involved virtual money.

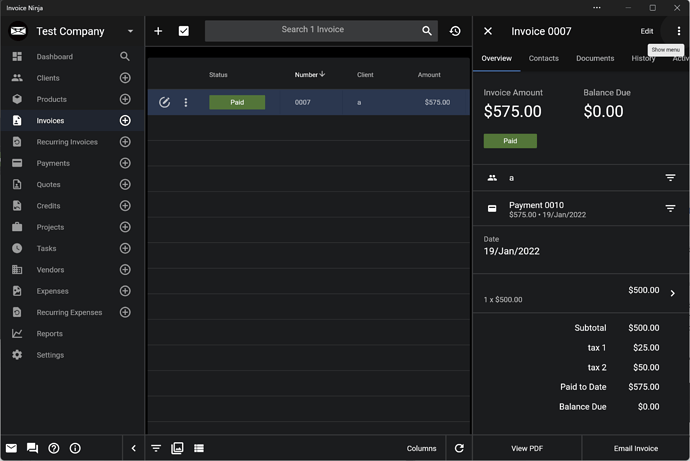

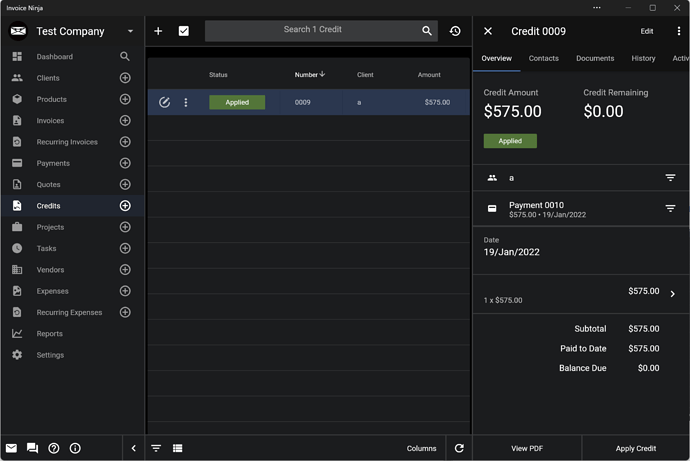

For instance, here I created an invoice with sales taxes that is completely “paid” with a credit or virtual money of the same value that I created without a “real” payment ever being made/noted:

The credit is at $0 and the invoice is fully paid.

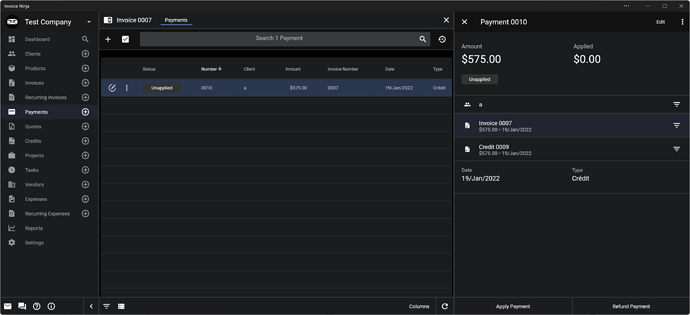

For some reason the payment is shown as “unapplied”

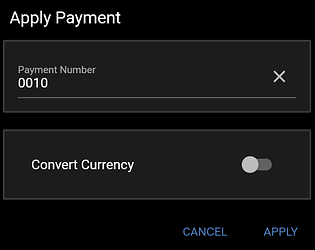

and when I click on “apply”, I only get to choose a Payment Number, and clicking “apply” once more does nothing.So yeah, this part really confuses me (and thanks in advance for anyone explaining it to me), but the part of paying the invoice with the “virtual” credit note did work.

My underlying question is: would it be possible to create a credit (say, for saying thanks to a regular client for his past business) that could be used like a rebate on file that could be deducted from future invoices, thus lowering their total (and the taxes applied to them) ? This would prevent “virtual” taxes and “virtual revenues” from being calculated in the reports.

I must add that the whole credit entity is pretty puzzling overall to me, since it means different stuff for different people (hence this very thread), and I would too have expected overpaid amounts to be available as credits, as discussed in the following thread (instead of separate “unapplied” payments that can be hard to track):

How or where do we see a customer’s credit on their account? - Hosted • invoicing.co | v5 - Discourse (invoiceninja.com)

Maybe there could be a new setting to automatically link unapplied payments to positive credits? That would make the whole “credit” thing more comprehensive and intuitive, IMO. But still, thanks for working on negative credits for now.