@david

Not 100%. It’s legally required it states “credit note”. Secondly it needs to be linked to a payment which currently throwing 2 validation errors.

Ok,

so credit note

linked to payment

but has a zero balance, correct? ie cannot be used for future payments and it just represents the refund?

Hi David,

like Bram already wrote, it is not just a receipt. It is like a negative invoice. Ideally there is an option to link a credit note to an invoice as in most cases the refund will be issued after an invoice was created.

In Bram’s example it is a security deposit. In my case it most often is something we billed incorrect or if we need to refund to client for work we billed and the customer is not happy with it. Luckely this happens only a few times a year but I still need some solution for it. In v4 it was easlily possible by entering a negative amount on an invoice. But that doesn’t work in v5 anymore.

Thanks for taking this in consideration.

Gijs

Thanks for explaining.

Bram’s case is quite simple to resolve, but it is still unclear to me what additional functionality you need.

After creating a negative invoice, did you want to apply a counter balancing payment so that you have a chain of records which explain the transaction?

This is also the case for us. For example we sometimes charge X amount of usage cost (e.g estimated fuel cost) but most often we overcharge. Thus we need to correct that in the credit note ![]()

Unfortunately we need to create a credit note for every single rental we do…

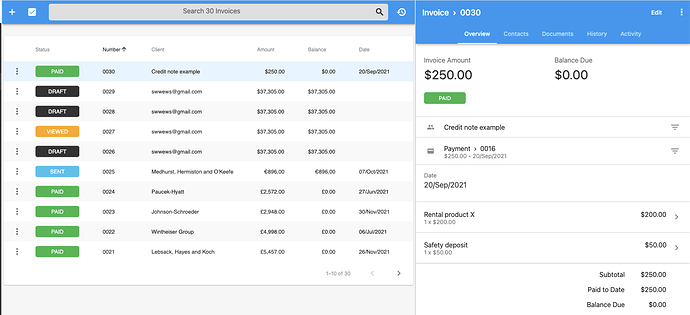

Let me show it to you in the demo environment.

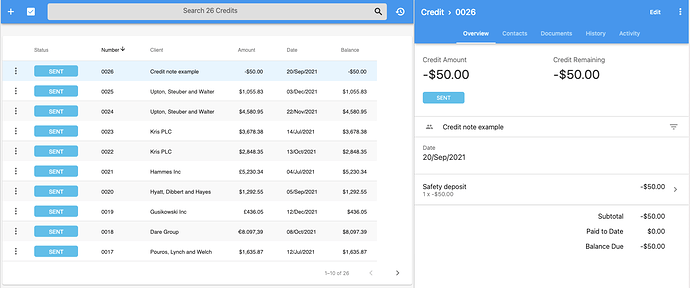

Here we have a paid invoice of 250$. After the event we need to pay back the safety deposit if nothing was wrong. So we create the credit note like so:

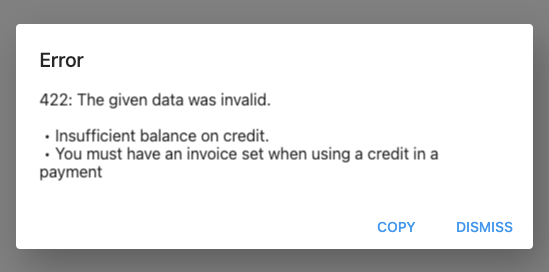

If we try to mark it as paid (clicking on the credit note and clicking add payment) we get the following error (after pressing save because the values are auto filled).

What I would expect is that:

A. I can enter a negative payment that has no effect on the balance

B. It marks the credit note as completed/reimbursed/paid/… whatever the status is that Invoce Ninja uses since I have never seen it ![]()

C. It is correctly displayed on the dashboard.

I hope this helps ![]()

Hi David,

As I tried to explain here:

The credit note should affect the total balance of the client account. So for this example:

Invoice: 500 $

Credit note: 100 $

Total balance: 400 $

The client can pay 400 $ and both invoice and credit note would be marked as paid.

If the client had already paid the invoice completely with 500 $, I would then payout the refund of 100 $. Then again the balance is 0 and both invoice and credit note are marked as paid.

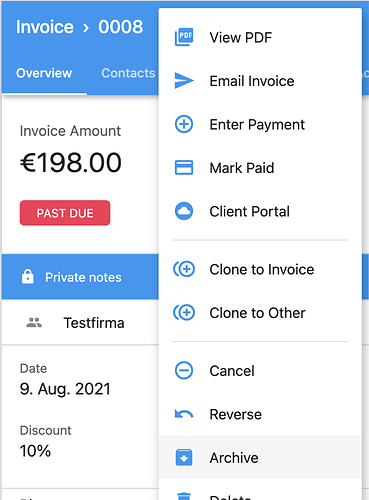

An ideal solution would also offer an option to link the credit note to the original invoice. For example by adding an additional option here:

But that is just a bonus.

Many thanks,

Gijs

I’ll need to think about how we can make this work.

Potentially creating a credit note from an invoice and then performing actions to zero it out and reduce the client paid to dates.

cc @hillel

Maybe it’s enough to add an extra toggle to the payment options?

Looking forward to your solution and more than happy to help brainstorming if required ![]()

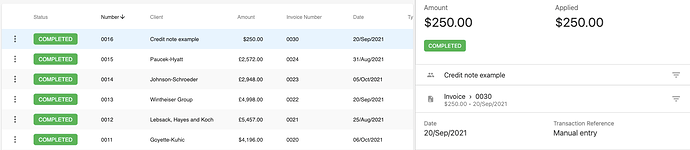

Here is what I did:

A client bought a couple of items from me then returned 2 of them after paying the full invoice amount, telling me to apply the refund/credit to future invoices.

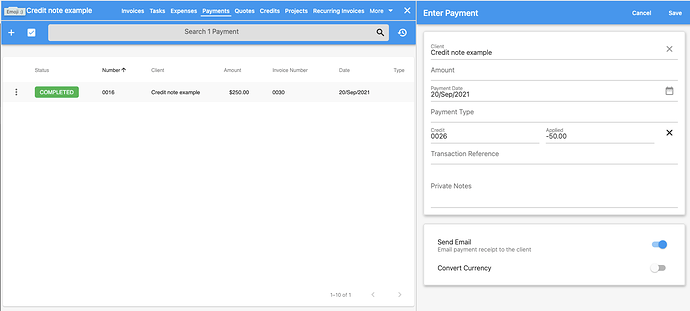

So I added a payment with the full amount and applied the payment to the invoice, then created a credit (under credits) with the refund amount. You have to mark the credit as sent or email it to the client.

To apply the credit to future invoices, here is what I did:

create payment select the client then under payment type will appear credit (you can select the amount of the credit from the list) and the payment amount will reflect the difference between the invoice and the credit.

The only thing is if the invoice amount is less than the credit amount invoice ninja will not accept it, it has to be same amount or the invoice is greater amount.

We need to partially apply the credit to multiple invoices for the same client, that will be great.

I just tried to apply partial credit, and it worked.

Test client has the following:

invoice $20

Credit $50

When you create payment you select the test client, credit appears under the payment type, you can select from the available credits available for the client. Select the desired credit and beside it, you will find it populated the full amount of the credit, in my case $50 - I edit that and made it $20 then, and it worked. Now that credit is partially applied, and the client has remaining credit of $30.

I hope that example for what I did helps.

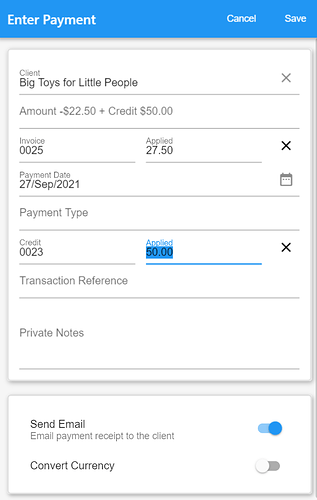

Yes, you can do that just fine. If you see in my screenshot, hitting Save like this will fail, because there is a negative payment amount seen above (-$22.5). But if you change the Credit Applied amount from the default over payment to match the invoice amount of $27.50, it will successfully apply the credit, and the credit record left behind will change from Sent to Partial allowing you to apply the remaining credit amount to another invoice.

Now that credit is partially applied, and the client has remaining credit of $30.

to apply the remaining credit amount to another invoice.

That’s not what we need. I need to be able to enter a negative payment because I send the refund directly back to the client. In my rental use case there is never a second invoice where I can use the credit/balance. Thus I need to be able to enter the negative payment and close the credit note.

Refer to my example here for my use case: Payment can't be applied to a credit note - #22 by bramdriesen

I think I see the problem.

A payment doesn’t have to be immediately applied to an invoice. You can manually enter a payment as a down payment, with no invoice linked to it. The payment would be marked UNAPPLIED, then PARTIAL once it is applied in part. You can add a public note to the payment for your records to remind you what invoice the down payment is meant for, and when you are finished your work. Then you can finally apply partial payment and the credit to the original invoice, and issue partial refund, with notes on the credit and invoice records explaining why there is differences, for your records.

Is that a solution you can work with?

I see you both have different circumstances so this might only work in some ideal situations.

So in your example you gave a negative value to a credit note, but a credit note is already a negative value, so you created a double negative, hence your error. In your example, I think you need to give the credit note a non negative value, then issue a partial refund on the original payment (when refunding the original payment record it will prompt a manual refund amount) and then you can apply your credit note to the original invoice to balance it out.

Try out in the demo environment.

The result may not link your original payment to the credit but it will link both to the original invoice.

I know when you select an invoice and then select enter a payment, it will not give an option for a credit, which I consider a bug. Because when you manually enter a payment from the client screen or the payment screen, and credits are available you will see a credit field in the payment screen, and you can manually apply any available credit notes to any available invoices.

The system should take care of that. Not a manual step that can be forgotten and is not structured. Not to mention there is no real link between them, it’s just text.

Please read the part about editing invoices. This is not allowed in the EU. Once an invoice is sent to the customer you can not alter it.

Also editing an original payment seems wrong. Because the customer paid the full amount including the safety deposit. And we as the vendor pay back that deposit. Those are 2 separate transactions that can be months if not years apart. (We have currently some safety deposits for a rental in 2023…)

No

I tried that, but that still throws an error about the invoice and balance. Unfortunately someone really messed up the demo environment that prevents me from showing you with screenshots.

PS: The fact this requires so much discussion and confusion shows how broken this part is in V5  in V4 this just worked like intended.

in V4 this just worked like intended.

Thanks for thinking with us

I know, the credit module needs some work. I think it will get there, these discussions are necessary to bring it there.

True, but this has not been given enough thought while moving to V5. E.g all negative payments created in V4 were simply not migrated into V5. It was a huge job on our part to manually re-enter all these…

I’m back looking into this. And i have a potential solution.

- Generate a negative payment:

The workflow looks like this.

Create a negative payment associated to a selected invoice.

This creates a credit note for the negative payment amount (which effectively cancels each other out) and the credit note is generated with a reference to the selected client/invoice.

This combination will reduce the clients Paid To Date amount.

Does this sound ok?